Aspen Company Estimates Its Manufacturing Overhead to Be

Job 2-1 which was sold during year 2 had actual direct labor costs of 195000. Aspen worked on three jobs for the year.

Solved Aspen Company Estimates Its Manufacturing Overhead To Chegg Com

Job 2-1 which was sold during year 2 had actual direct labor costs of 370000.

. Accounting questions and answers. Aspen Company estimates its manufacturing overhead to be 622800 and its direct labor costs to be 519000 for year 2. Job 2-1 which was sold during year 2 had actual direct labor costs of 195000.

Aspen Company estimates its manufacturing overhead to be 631250 and its direct labor costs to be 505000 for year 2. Aspen worked on three jobs for the year. Aspen Company estimates its manufacturing overhead to be.

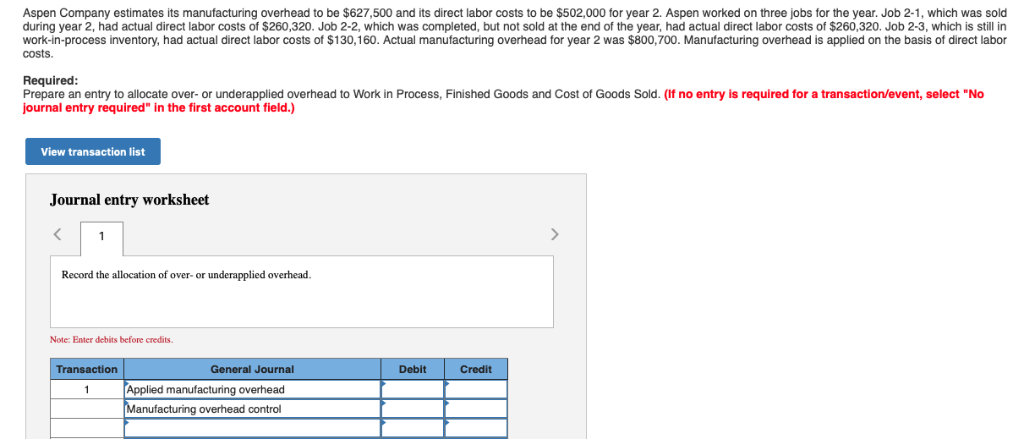

Job 2-1 which was sold during year 2 had actual direct labor costs of 370000. Aspen Company estimates its manufacturing overhead to be 553300 and its direct labor costs to be 503000 for year 2. Aspen worked on three jobs for the year.

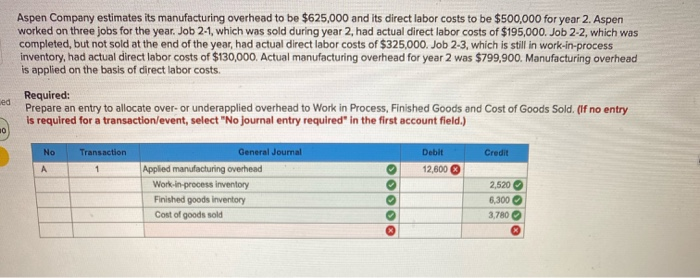

Aspen Company estimates its manufacturing overhead to be 625000 and its direct labor costs to be 500000 for year 2. Aspen Company estimates its manufacturing overhead to be 553300 and its direct labor costs to be 503000 for year 2. Aspen worked on three jobs for the year.

Accounting questions and answers. Job 2-1 which was sold during year 2 had actual direct labor costs of 168000. Aspen worked on three jobs for the year.

As install a variable frequency drive VFD on the air compressors motor. Job 2-1 which was sold during year 2 had actual direct labor costs of 195000. Aspen worked on three jobs for the year.

Job 2-2 which was completed but not sold at the end of the year had actual direct labor costs of. Job 2-2 which was completed but not sold at the end of the year had actual direct labor costs of 325000. Company proposes to install destratification fans that will balance and equalize the temperature within the buildings as well.

Job 2-2 which was completed but not sold at the end of the year had actual direct labor costs of 411000. 8F CLEAN ENERGY ORDER DOCKET NO. Job 2-2 which was completed but not sold at the end of the year had actual direct labor costs of 326000.

Aspen worked on three jobs for the year. Aspen Company estimates its manufacturing overhead to be 625000 and its direct labor costs to be 500000 for year 2. Aspen worked on three jobs for the year.

Aspen Company estimates its manufacturing overhead to be 625000 and its direct labor costs to be 500000 for year 2. Job 2-1 which was sold during year 2 had actual direct labor costs of 174000. Compare how recession-proof Unidynamics Inc.

Overhead rate Estimated manufacturing overheadEstimated direct labour cost635000508000125 of d. Job 2-2 which was completed but not sold at the end of the year had actual direct labor costs of 325000. Job 2-1 which was sold during year 2 had actual direct labor costs of 188000.

Job 2-2 which was completed but not sold at the end of the year had actual direct labor costs of. Aspen Company estimates its manufacturing overhead to be 510000 and its direct labor costs to be 510000 for year 2. Aspen Company estimates its manufacturing overhead to be 625000 and its direct labor costs to be 500000 for year 2.

Aspen worked on three jobs for the year. Ewcp is relative to the industry overall. Job 2-1 which was sold during year 2 had actual direct labor costs of 195000.

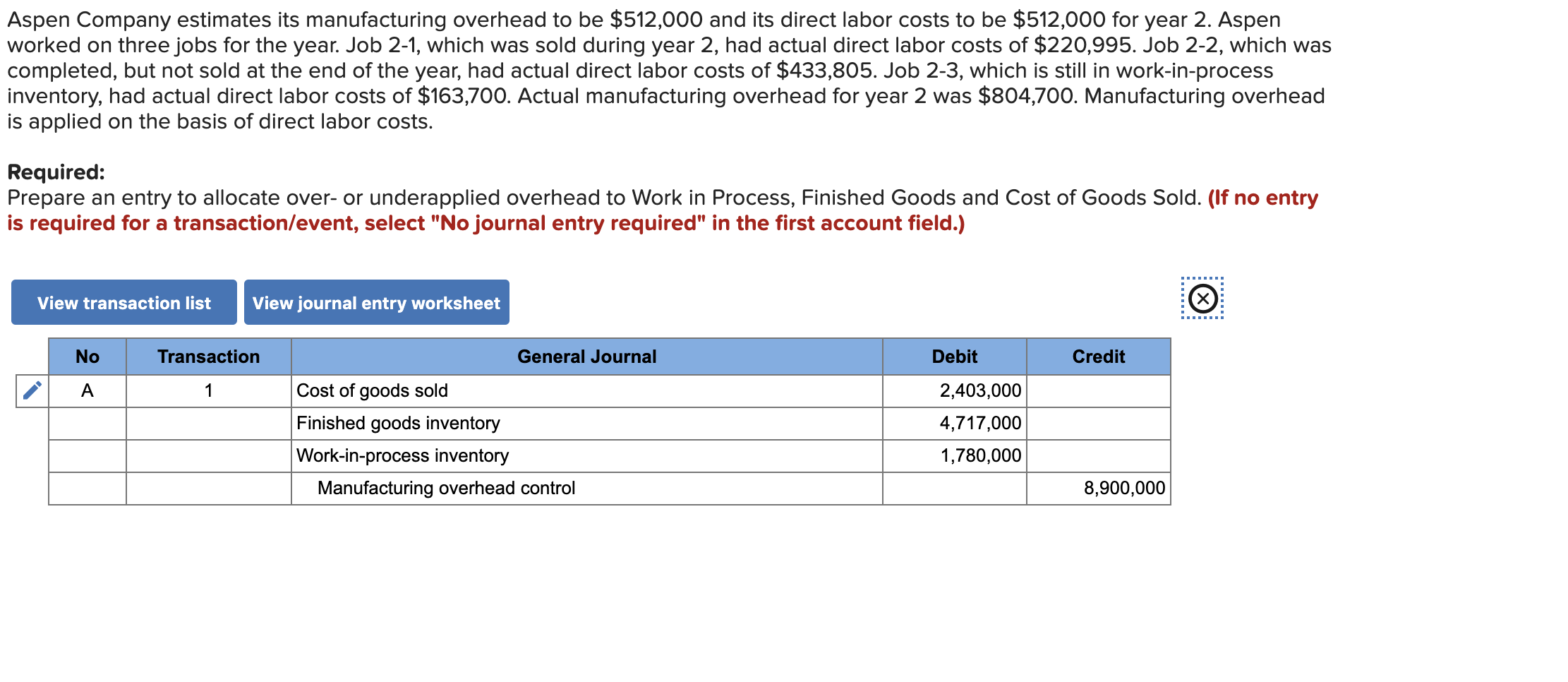

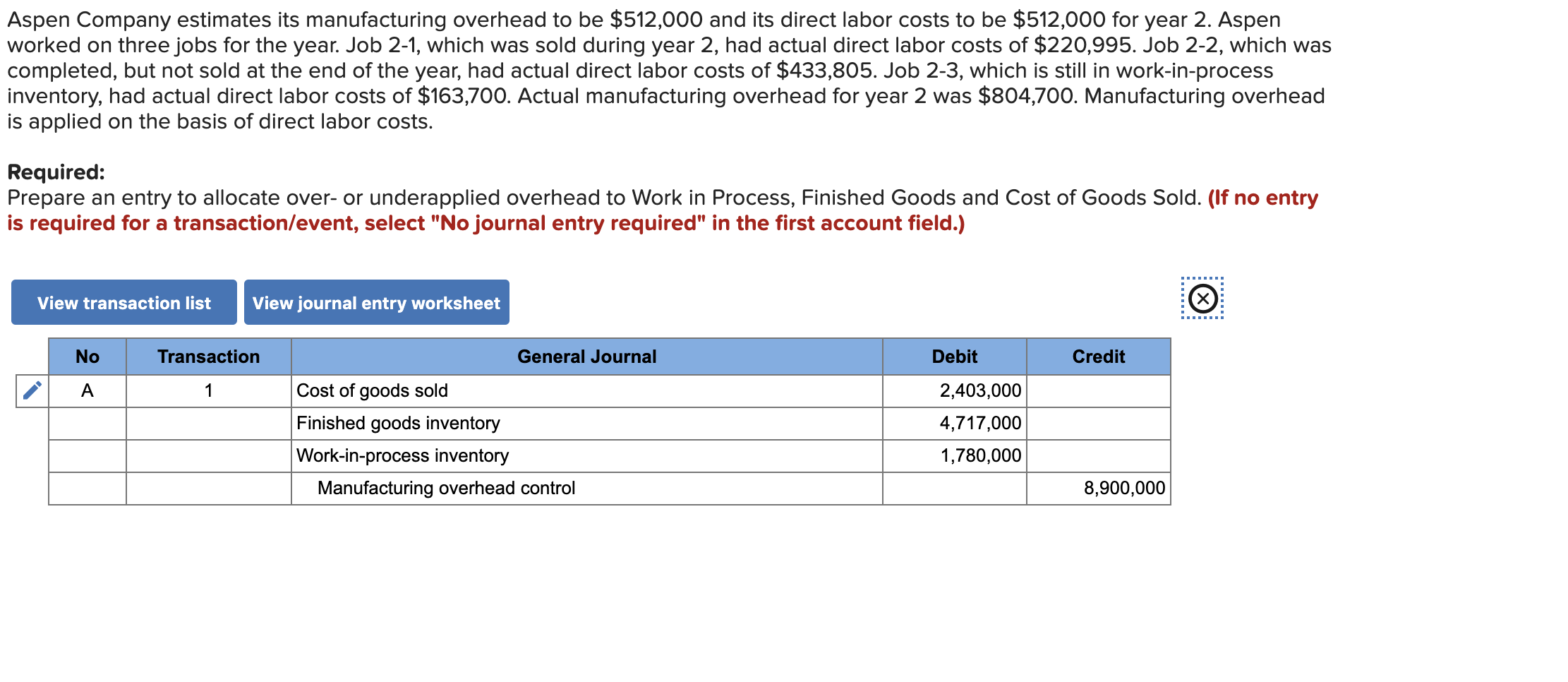

Job 2-1 which was sold during year 2 had actual direct labor costs of 220725. Job 2-1 which was sold during year 2 had actual direct labor costs of 195000. Aspen worked on three jobs for the year.

Aspen Company estimates its manufacturing overhead to be 635000 and its direct labor costs to be. Aspen Company estimates its manufacturing overhead to be 631250 and its direct labor costs to be 505000 for year 2. Job 2-2 which was completed but not sold at the end of the year had actual direct labor costs of 416925.

Aspen worked on three jobs for the year. Aspen worked on three jobs for the year. Aspen Company estimates its manufacturing overhead to be 891000 and its direct labor costs to be 540000 for year 2.

Job 2-1 which was sold during year 2 had actual direct labor costs of 195600. The estimated first incentive for purchase of. Aspen worked on three jobs for the year.

625000 and its direct labor costs to be 500000 for year 2. Aspen Company estimates its manufacturing overhead to be 1376000 and its direct labor costs to be 640000 for year 2. Bruce Grossman South Jersey Gas Company Susan Ringhof Public Service Electric and Gas Company Andrew Dembia New Jersey Natural Gas Mary Patricia Keefe Elizabethtown Gas Agenda Date.

Aspen Company estimates its manufacturing overhead to be 1026000 and its direct labor costs to be 570000 for year 2. Job 2-1 which was sold during year. Accounting questions and answers.

Brand Esq Director New Jersey Division of Rate Counsel BY THE. While a new recession may strike a particular industry measuring the industry and companys robustness during the last recession estimates its ability to weather future. Job 2-1 which was sold during year 2 had actual direct labor costs of 130150.

Job 2-2 which was completed but not sold at the end of the year had actual direct labor costs of 325000. This is useful in estimating the financial strength and credit risk of the company. Job 2-2 which was completed but not sold at the end of the year had actual direct labor costs of 325000.

Aspen worked on three jobs for the year. Job 2-2 which was completed but not sold at the end of the year had actual direct labor costs of 293000.

Solved Aspen Company Estimates Its Manufacturing Overhead To Chegg Com

Solved Aspen Company Estimates Its Manufacturing Overhead To Chegg Com

Solved Aspen Company Estimates Its Manufacturing Overhead To Chegg Com

Comments

Post a Comment